- Daily Update from Securities Docket

- Posts

- With Public Listings Declining, Can SEC Chairman Atkins "Make I.P.O.s Great Again?"

With Public Listings Declining, Can SEC Chairman Atkins "Make I.P.O.s Great Again?"

Plus Securities Docket announces Enforcement Elite and Enforcement Hall of Fame.

Good morning! Here’s what’s up.

Securities Docket Announces “Enforcement Hall of Fame” Class of 2025

On Thursday, October 30, 2025, Securities Docket announced its “Enforcement Hall of Fame” Class of 2025. We announced the 10 new members of the Enforcement Hall of Fame at the conclusion of Securities Enforcement Forum D.C., which was held at the Mayflower Hotel in Washington, D.C. The 10 lawyers honored in the Class of 2025 are:

The Enforcement Hall of Fame is Securities Docket’s list of the lawyers “who have made the most extraordinary contributions to, and impact upon, the field of securities enforcement over their lifetimes.”

Full information on the Enforcement Hall of Fame is available here.

Securities Docket Announces ‘Enforcement Elite’ for 2025

Securities Docket also announced its “Enforcement Elite” for 2025 at the conclusion of Securities Enforcement Forum D.C. This is our list of the best securities enforcement defense lawyers in the business.

Please allow me to quote myself from Friday’s announcement:

“Securities Docket received nominations and conducted significant research to arrive at this list of the top practitioners in this highly-specialized area of law — the lawyers you would turn to if you, your company or a family member were faced with an important SEC enforcement matter,” Carton said. “I am confident that this year’s Enforcement Elite is a group of stellar attorneys who are worthy of this special recognition.”

Full information on this year’s Enforcement Elite is available here.

People

Jose Lopez, former senior enforcement attorney at the SEC, has joined Dorsey & Whitney as a partner n the firm’s new Chicago office.

Clips ✂️

Can Paul Atkins ‘Make I.P.O.s Great Again’?

“You want to stay private as long as possible,” Edwin Chen, the founder of Surge AI, recently told DealBook. His company, he said, has about a billion dollars in annual revenue and is definitely not considering an initial public offering right now.

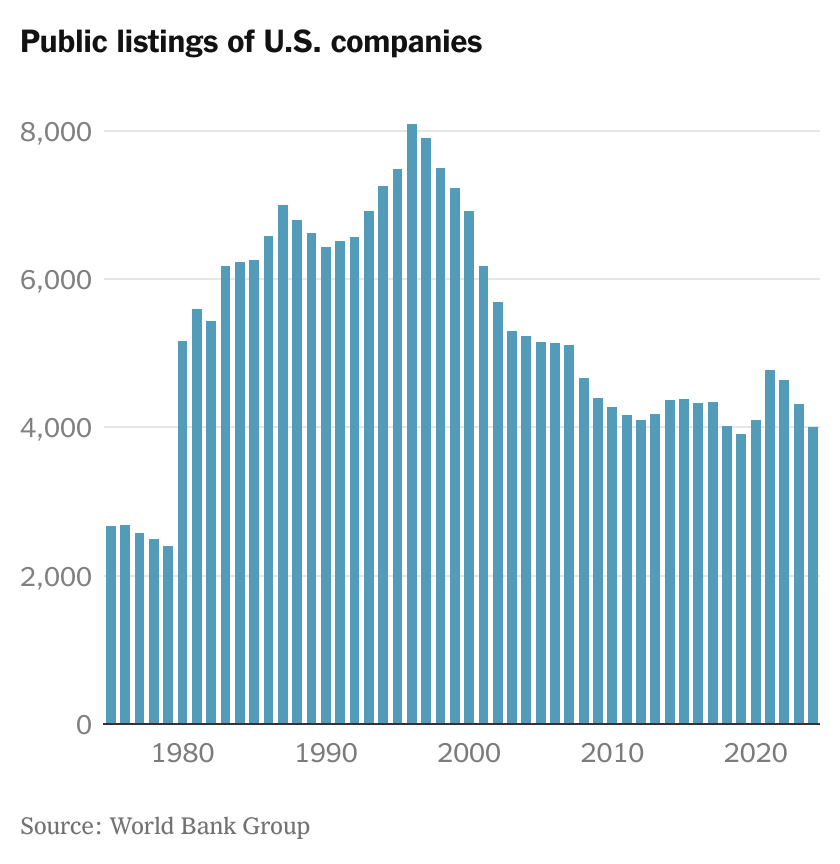

Despite a soaring stock market, an increasing number of executives seem to share Chen’s philosophy: The number of U.S. public listings dropped from a peak of 8,090 in 1996 to 4,010 last year, according to data from the World Bank.

Fewer companies are filing for I.P.O.s, and more public companies are being taken private.

That’s a problem for those who consider public markets to be a critical economic engine. And Paul Atkins, the Trump-appointed chairman of the Securities and Exchange Commission, has vowed to “make I.P.O.s great again.”

👉 Interesting chart from the article:

CZ Pardon News: Trump Tells CBS News He ‘Doesn’t Know’ Who Binance’s Changpeng Zhao Is

President Trump reiterated his claim that he doesn’t know who Binance founder Changpeng ‘CZ’ Zhao is during an interview with CBS News.

Trump granted Zhao a presidential pardon in October, nearly a year after the Binance founder pleaded guilty to violating the Bank Secrecy Act and serving a four-month prison sentence.

Trump told CBS’s Norah O’Donnell that Zhao “was treated really badly by the Biden administration,” describing the former Binance CEO as a “victim of weaponization by government.” The president added that he had been told Zhao “was set up,” and that his pardon was intended to ensure the U.S. remained competitive in the cryptocurrency sector.

“I don’t know the man at all. I don’t think I ever met him,” Trump said during the interview with CBS. “Maybe I did. Or, you know, somebody shook my hand or something. But I don’t think I ever met him. I have no idea who he is. I was told that he was a victim, just like I was and just like many other people.”

SBF News: Appeals Court to Hear Sam Bankman-Fried’s Bid to Redo FTX Fraud Trial

FTX founder and former CEO Sam Bankman-Fried’s gamble that the U.S.’s legal system will set him free three years after his empire collapsed may be about to hit its end.

The Second Circuit Court of Appeals will hear arguments in Bankman-Fried’s effort to appeal his conviction and 25-year prison sentence two years and two days after a jury unanimously found him guilty on seven different conspiracy and fraud charges.

The Nov. 4 hearing will allot both Southern District of New York prosecutors, now run by former Securities and Exchange Commission Chair Jay Clayton, and Bankman-Fried’s new defense team headed by leading white collar appellate attorney Alexandra Shapiro 10 minutes apiece to present their arguments. The judges on the panel may ask their own questions during the proceeding to clarify details.

The hearing will not relitigate the charges themselves, but rather, whether the trial was conducted appropriately.

X

O'DONNELL: Why did you pardon Changpeng Zhao?

TRUMP: Are you ready? I don't know who he is

O'DONNELL: His crypto exchange Binance helped facilitate a $2b purchase of World Liberty Financial's stablecoin. And they you pardoned him.

TRUMP: Here's the thing -- I know nothing

— Aaron Rupar (@atrupar)

12:55 AM • Nov 3, 2025

Daylight savings is not enough. You need to be daylight investing.

— Douglas A. Boneparth (@dougboneparth)

12:35 PM • Nov 2, 2025

Amazon just posted a job for “Crypto Social Ecosystem Lead” with a $370K–$514K salary range.

— TFTC (@TFTC21)

6:26 PM • Sep 15, 2025