- Daily Update from Securities Docket

- Posts

- The Return of “Naked, Homeless and Without Wheels”

The Return of “Naked, Homeless and Without Wheels”

Plus the Eight Circuit pauses challenges to the SEC's climate rule.

SPONSORED BY

Good morning! Here’s what’s up.

People

Amy Stahl Cotter, former Assistant Director in the SEC’s Division of Enforcement, has joined Lewitas Hyman as a partner in the firm’s Chicago office.

Clips ✂️

Donald Trump’s new SEC appointee scraps aggressive enforcement agenda

The head of the top Wall Street watchdog has pledged to give businesses notice of technical violations before “bashing down their door”, as he scraps the aggressive enforcement agenda pursued under former president Joe Biden.

Paul Atkins, who this year was appointed chair of the Securities and Exchange Commission by US President Donald Trump, told the Financial Times in an interview in Paris that the agency was geared to go after “crooks”.

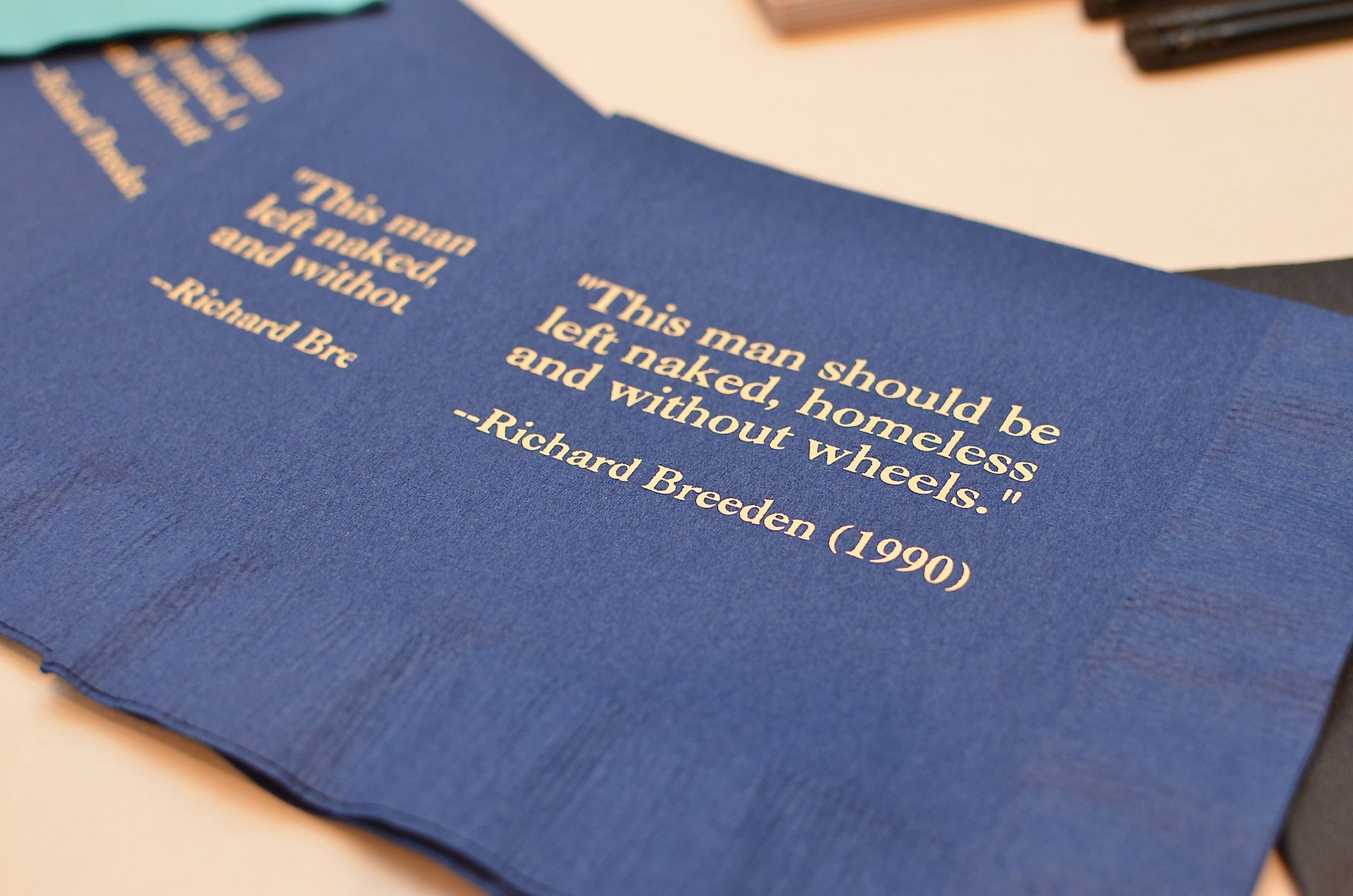

“If you lie, cheat or steal your investors and steal their money like [disgraced former financier] Bernie Madoff, we’ll leave you naked, homeless and without wheels,” Atkins said, quoting a sign posted in the office of his first SEC boss Richard Breeden.

But he added there were “other gradations of that where you have to give people notice”.

“You can’t just suddenly come and bash down their door and say ‘uh-uh we caught you, you’re doing something and it’s a technical violation’,” he said.

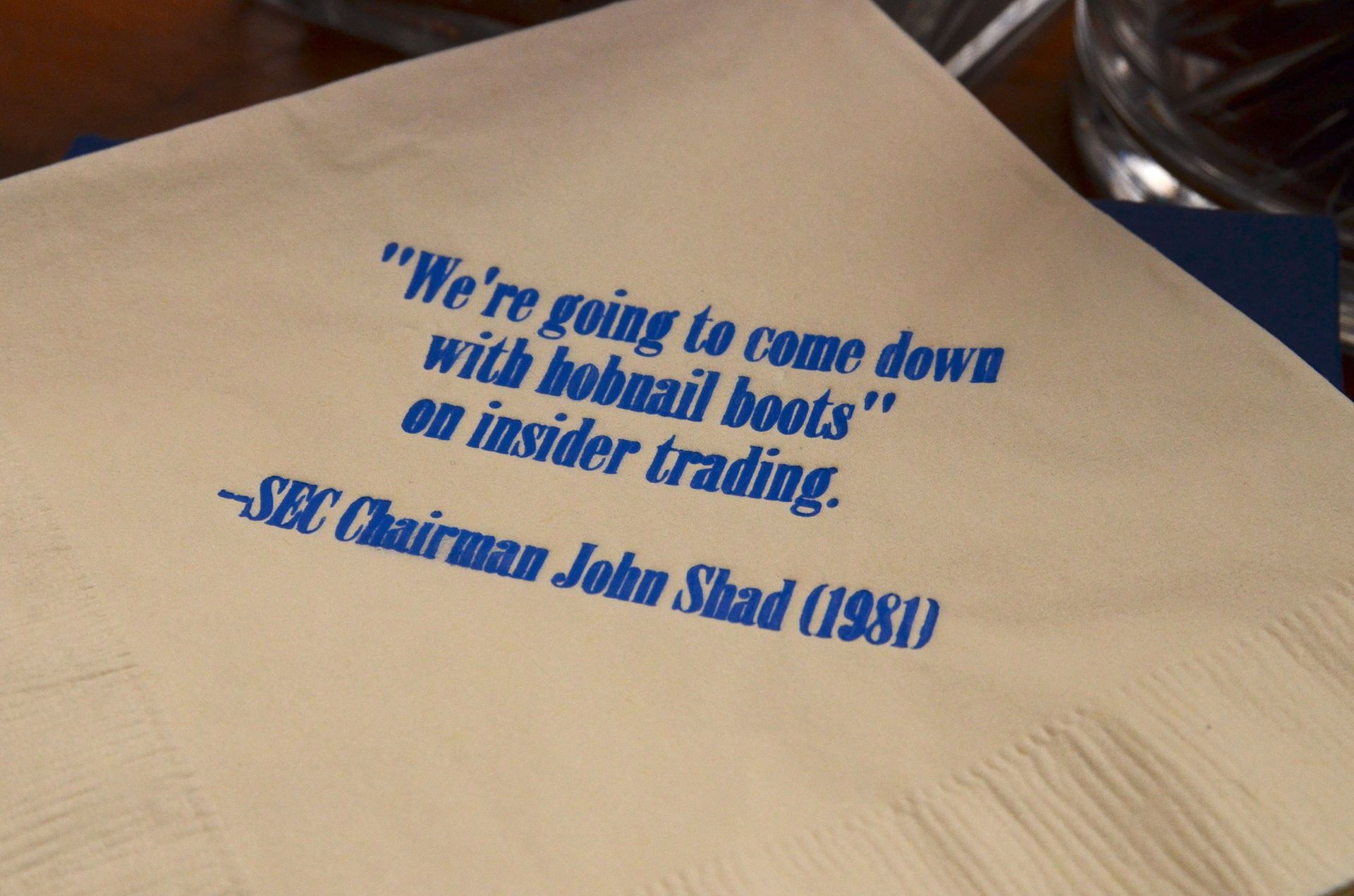

👉 Flashback to our “Naked, Homeless and Without Wheels” napkins 10 years ago at Securities Enforcement Forum 2015!

Here are some of the other excellent papers products from that event:

SEC: Keeping Musk Securities Case in D.C. Is Best for Attorneys

The U.S. Securities and Exchange Commission is pushing back on Elon Musk’s request to move a securities enforcement action against him to the Western District of Texas, claiming the U.S. District Court for the District of Columbia is the proper venue for the allegation of failing to file a disclosure form on time.

In the SEC’s response to Musk’s motion to transfer, the agency cited convenience for the attorneys involved as one of the primary reasons the action should stay in D.C.

U.S. District Judge Sparkle L. Sooknanan is presiding over the case, which involves the 2022 disclosure of Musk’s acquisition of stock in what was at the time Twitter Inc.

“Attorneys must attend hearings and conferences, which will be more convenient in the District of Columbia because both the SEC and Musk are represented in this case by attorneys who work here.,” the SEC said in Thursday’s filing. “No attorney representing either party lives or works in the Western District of Texas. Requiring D.C.-based SEC attorneys to travel to Texas for every hearing and conference in this case would not be an efficient use of government resources, especially when no witnesses are needed to resolve the SEC’s claim as to liability.”

US Appeals Court Hits Pause on Challenges to SEC Climate Rule

A federal appeals court on Friday said it was pausing its consideration of legal challenges against the U.S. Securities and Exchange Commission’s climate regulations until the Wall Street regulator decides whether it plans either to change them or to defend them in court, court papers showed.

Under former President Joe Biden, the SEC adopted rules requiring publicly traded companies to tell investors about climate-related risks, emissions and spending, with Republican-led states and one industry group immediately challenging this in court. Under Republican President Donald Trump, the SEC voted in March to cease defending the rule.

In an order on Friday, the U.S. Court of Appeals for the Eighth Circuit said that, because the SEC had refused either to defend the rule in court or say whether it planned to modify or scrap the rule entirely, the legal challenges “will be held in abeyance to promote judicial economy.”

Australia’s ANZ to pay $160 million over bond deal, customer violations

ANZ Group agreed to pay A$240 million ($159.5 million), the Australian corporate regulator’s largest-ever penalties against a single entity, over systemic failures ranging from acting “unconscionably” in a government bond deal to charging dead customers.

The penalties announced on Monday are a troubling milestone for Australia’s fourth-largest bank, which last week announced 3,500 job cuts as new CEO Nuno Matos looks to improve profitability at a lender that already is required to hold more capital in reserve than its peers due in part to fallout from the bond deal.

👉 The Australian Securities & Investments Commission’s (ASIC) press release is here.

ASIC Chair Joe Longo said that “time and time again ANZ betrayed the trust of Australians…. The total penalties across these matters are the largest announced by ASIC against one entity and reflect the seriousness and number of breaches of law, the vulnerable position that ANZ put its customers in and the repeated failures to rectify crucial issues.”

SPONSORED BY

Securities Enforcement Forum Central 2025 is set for Thursday, September 25, 2025 at the Ritz-Carlton Chicago! Join us in person or tune in virtually to hear from 40+ luminaries in the securities enforcement field—including numerous senior officials from the SEC, in-house counsel from major corporations, and lawyers and consultants from the best firms and in the world.

👉 Please register here. See you September 25 in Chicago!!!

"A “New Day at the SEC” – The Impact of Changes in Leadership, Priorities, and Organization … and What Comes Next"

Panelists:

Rachel Copenhaver, Partner, Vedder Price

Keith Constance, Managing Director, FTI Consulting

Tina Diamantopoulos, Regional Director, SEC

Jose A.— Securities Docket (@SecuritiesD)

4:22 PM • Sep 9, 2025

X

Breaking news: Donald Trump has called for US companies to stop reporting quarterly results, adding that a shift to publishing figures twice a year will save them cash and allow executives to focus on their businesses. on.ft.com/464UCnD

— Financial Times (@FT)

12:11 PM • Sep 15, 2025

🇺🇸 JUST IN: Tether will launch a US-based stablecoin, $USAT, with former White House crypto executive director Bo Hines as its CEO.

— Cointelegraph (@Cointelegraph)

3:46 PM • Sep 12, 2025

"We see $BTC trading at $1 million a bitcoin if it disrupts gold. And we think bitcoin is gold 2.0," says @Gemini Co-Founders @tyler & @cameron.

— Squawk Box (@SquawkCNBC)

3:41 PM • Sep 12, 2025