- Daily Update from Securities Docket

- Posts

- SEC Dismisses SolarWinds Case with Prejudice

SEC Dismisses SolarWinds Case with Prejudice

Plus Bitcoin continues to crash.

SPONSORED BY

Good morning! Here’s what’s up.

People

Christina Milnor, former Senior Attorney in the SEC’s Division of Enforcement, OGC, and the Office of the Secretary, has launched Milnor Law PLLC.

Clips ✂️

SEC to Drop Controversial SolarWinds Cyberattack Lawsuit

The US Securities and Exchange Commission will drop its landmark lawsuit against SolarWinds Corp. that accused the company of covering up internal problems ahead of a massive cyberattack.

The SEC, the software company and its top information security official jointly asked a federal court in Manhattan to end the case, according to an agreement filed on Thursday. The agency and Solarwinds in July said they had reached an agreement to settle the allegations.

The agency said the decision to seek dismissal is “in the exercise of its discretion” and “does not necessarily reflect the Commission’s position on any other case.” A SolarWinds spokesperson said the company was “clearly delighted” with the dismissal.

👉 The SEC’s Litigation Release announcing the dismissal of the case with prejudice is here.

On his LinkedIn, SolarWinds CISO Tim Brown, who was one of the defendants in the case, wrote:

“It’s been a long road and I’m glad it is finally over. We did nothing wrong and fought relentlessly over the last three years to prove that. We did not take the easy road although it was tempting many times. I’m so thankful for SolarWinds, it is the best company and leadership team in the world. I’m also thankful for my security community. You allowed me to share, to teach, to vent, to laugh and to see some good come from my ordeal. I truly believe this would not have ended this way without the best legal teams in the world having our back….”

Alec Koch, a King & Spalding partner representing Brown, stated on his LinkedIn that Brown had handled the case “with amazing dignity, class, and selflessness, and I couldn't be happier for you. Hats off to the incredible teams at Latham, Debevoise, and SolarWinds who worked so hard and so well to get to this just result, as well as my colleagues at K&S.”

SEC Enforcement Actions Dropped 30% under Paul Atkins: Report

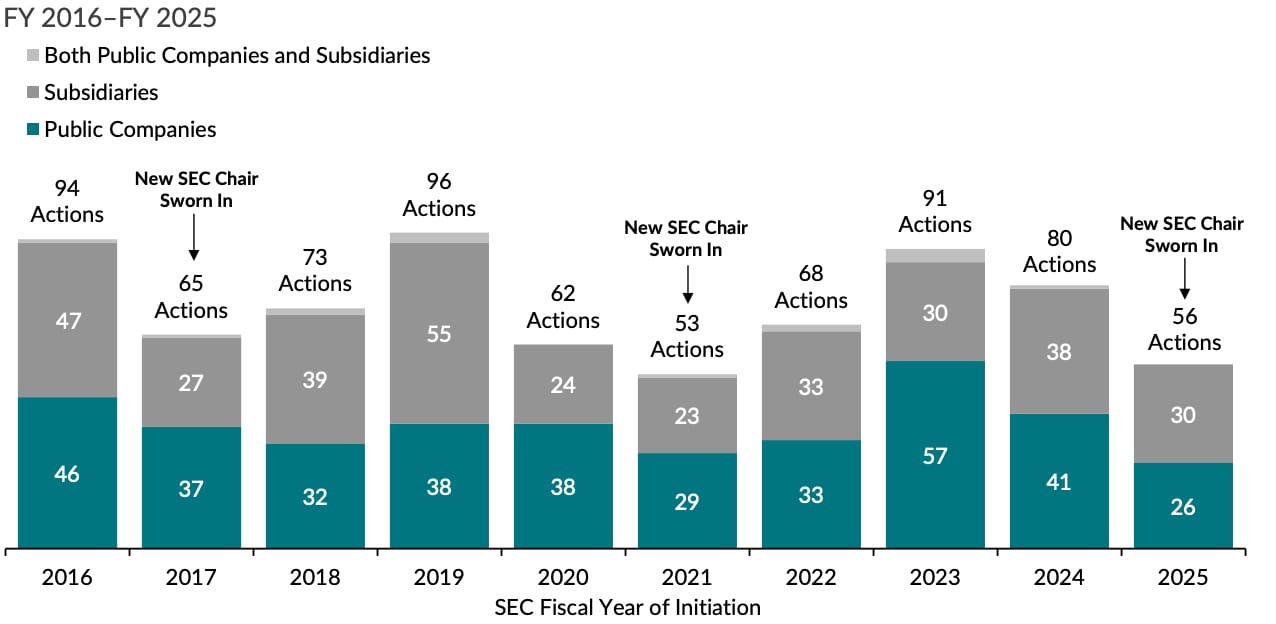

Consulting company Cornerstone Research reported a significant drop in the number of enforcement actions implemented by the current leadership of the US Securities and Exchange Commission, compared to that under the previous administration.

In a report released on Wednesday, Cornerstone reported that, under SEC Chair Paul Atkins, the number of enforcement actions against public companies and their subsidiaries decreased by about 30% in fiscal year 2025 compared to those in fiscal year 2024.

The company said the data was “consistent with the general pattern for other fiscal years when the SEC administration changed,” referring to former Chair Gary Gensler.

👉 The Cornerstone Research report by Stephen Choi, Sara Gilley and others at the firm contains this interesting chart showing the pattern when a new SEC Chairman is sworn in.

JPMorgan Had to Pay for Charlie Javice’s Legal Fees — and Her Restaurant Bills

What would you do if the federal government wanted you in jail and Jamie Dimon was paying your legal bills?

Here’s what Charlie Javice did: She spent money on luxury hotel upgrades, extravagant meals and cellulite butter, a personal care product that some people use to treat their skin, as a lawyer for the bank said in a hearing on Friday.

Then, she sent the receipts to the bank.

👉 I love the first sentence of this article by Ron Lieber of the NYT:

“What would you do if the federal government wanted you in jail and Jamie Dimon was paying your legal bills?”

Pillsbury Fights to Keep Nearly $4 Million in Client Money Sought by SEC

Counsel for Pillsbury Winthrop Shaw Pittman on Wednesday urged the U.S. Court of Appeals for the Second Circuit to overturn a lower court ruling that the firm must return millions of dollars in a retainer paid before the client’s assets were frozen.

Pillsbury partner Anne Voight argued the more than $3.6 million became the firm’s property when the client, Adam Rogas, retained Pillsbury and transferred the funds just days before he was charged with securities fraud. Therefore, a freeze order targeting Rogas’ assets could not apply to the retainer, she said.

Meanwhile, the U.S. Securities and Exchange Commission says that Rogas retained an interest in the retainer, as it covered work to be done on his behalf, and that therefore the money is clearly covered in the language of the retainer.

“The funds were being used for Mr. Rogas’ benefit,” SEC Attorney Paul Alvarez said, adding the ruling included language covering a “person or entity holding any funds for the benefit of Mr. Rogas.”

“Those funds were being used to his legal defense and therefore are conferring a benefit,” the lawyer said.

👉 On her LinkedIn, Sarah Heaton Concannon of Quinn Emanuel writes:

“Taken to its logical conclusion, this would mean that any SEC respondent/defendant for whom the SEC can get an ex parte asset freeze (which is many, and not limited to meritorious cases) would not be able to retain qualified counsel for his or her defense. Reminder that there's no right to Court-appointed counsel in civil litigation, nor during the investigative phase of an SEC case.”

Bitcoin Heading for Worst Month Since Crypto Collapse of 2022

Bitcoin is on track for its worst monthly performance since a string of corporate collapses rocked the wider crypto sector in 2022.

The largest cryptocurrency slid as much as 6.4% to $81,629 on Friday. Runner-up Ether fell as much as 7.6% to below $2,700 and a host of smaller tokens nursed similar declines. The total market value of virtual coins dropped below $3 trillion for the first time since April, data from CoinGecko show.

SPONSORED BY

Securities Enforcement Forum New York 2026 is set for Thursday, February 5, 2026 at the historic JW Marriott Essex House! Join us in person or tune in virtually to hear from nearly 50 luminaries in the securities enforcement field—including numerous senior officials from the SEC and DOJ, in-house counsel from major corporations, and lawyers and consultants from the best firms and in the world.

👉 Please register here. See you February 5 in New York!!!

X

👉 Indeed it does! Be right back, I need to order my “2008 Global Financial Crisis” hoodie while supplies last.