- Daily Update from Securities Docket

- Posts

- SEC Commissioner Crenshaw Departs Agency

SEC Commissioner Crenshaw Departs Agency

Plus Dixie Johnson, a luminary of the securities enforcement bar, announces her retirement.

SPONSORED BY

Good morning! Here’s what’s up.

People

Dixie Johnson, a partner at King & Spalding and a luminary in the securities enforcement bar, announced her retirement from the practice of law after over 39 years in private practice.

👉 Congrats, Dixie!!!

Clips ✂️

Journalism-Powered Hedge Fund Hunterbrook Capital Finds Good News Can Be Profitable

Hedge fund Hunterbrook Capital launched less than two years ago with $100 million and what it called a “news-driven strategy.” An affiliated team of journalists would publish exposés on corporate wrongdoing, and the fund would short the stocks of their targets ahead of time.

In 2025, it learned that good news can be just as profitable as bad.

Hunterbrook Capital gained 23% after fees last year through September, according to an investor letter viewed by The Wall Street Journal. That was higher than indexes tracking hedge-fund performance, as well as the roughly 15% return of the S&P 500 over the same period. Many of its best-performing positions were bullish bets on stocks based on reporting from its sister newsroom, Hunterbrook Media.

👉 Hunterbrook is the latest venture to try the “legal insider trading” approach to investing pioneered by Mark Cuban’s ShareSleuth. The article notes that while researching a company it thought might be overhyped/fraudulent, Hunterbrook uncovered positive news that led it to purchase the company before a price jump.

Speaking of legal insider trading, the New Republic reports that a “suspicious new user on the prediction market Polymarket just made [$400,000 in one day] on the Trump administration’s military strikes on Venezuela.” The user, who created an account on December 27, “has only bet on two things: the U.S. invading Venezuela, and its president, Nicolás Maduro, being forced out of leadership by January 31. The user bet $35,000 when the market estimated the probability of intervention in Venezuela at only 6 percent.”

Statement on Departure of Commissioner Caroline Crenshaw

Commissioner Caroline Crenshaw has devoted more than a decade of distinguished service to the Securities and Exchange Commission. Over those years, she has been a steadfast advocate for the agency’s mission – demonstrating clarity of purpose and generosity of spirit. Commissioner Crenshaw has listened carefully, engaged substantively, and approached every day with the purpose of safeguarding investors and strengthening our markets.

Those qualities are hardly surprising when you consider Commissioner Crenshaw’s broader record of service beyond the agency. As a major in the U.S. Army Reserve JAG Corps, she brings to her work a spirit of duty and a sense of discipline that reflects the very best of what this country asks of those who serve it.

👉 Caroline Crenshaw served as an SEC commissioner from August 17, 2020 to January 3, 2026.

Dallas mayor predicts ‘flood’ of Wall Street firms to quit NYC under Mamdani

The mayor of Dallas said he’s ready to welcome a “flood” of Wall Street firms if Zohran Mamdani follows through on his socialist agenda — and even claimed that Texas could overtake New York as the nation’s top financial hub.

In an exclusive sitdown interview with The Post, Dallas Mayor Eric Johnson said Mamdani’s socialist agenda for the Big Apple — including vows to hike taxes on the rich and expand government control over prices for housing, groceries, and childcare — could accelerate defections of big financial firms from the city.

The 50-year-old Republican, who majored in history as an undergraduate at Harvard, likewise floated the possibility that Wall Street is at risk of being toppled from its perch as America’s premier financial center — likening it to Venice, Italy losing its edge as Europe’s premier trading hub centuries ago.

“It’s not inconceivable at all that within a certain number of years, people look back and go, ‘Do you remember back when New York was the financial capital of the United States? Isn’t that weird?’” Johnson told The Post.

👉 More momentum for “Y’all Street.”

Quinn Emanuel Partners Join Rare Club With $9 Million Payouts

Quinn Emanuel expects to pay equity partners $9 million on average for 2025, becoming just the third large law firm to reach that profits mark.

The payout reflects a strong financial performance driven by demand for partner services, firm co-managing partner Michael Carlinsky said in an interview. The average volume of partner billings, some topping $2,000 per hour, outpaced that of associates, who charge lower rates. […]

The profits figure, a 4% increase from the more than $8.6 million Quinn Emanuel gave partners in 2024, strengthens the firm’s position as it competes with rivals for top industry talent. Only two law firms among the 100 largest by revenue, Kirkland & Ellis and Wachtell Lipton Rosen & Katz, tallied more than $9 million in profits per equity partner in 2024, based on figures published by the American Lawyer.

Event-Driven, AI Cases Dominate 2026 Securities Litigation Field

With the massive growth of artificial intelligence has come massive growth in AI-related securities litigation. There were between six and eight AI-related securities cases each year between 2021 and 2023, followed by 15 such cases in 2024 and 12 more just in the first half of 2025. We expect this trend to continue in 2026.

One of the reasons for this rise is that quantifying AI capabilities and measuring AI performance present a fundamental challenge for public companies. Securities litigation typically follows when optimistic projections cross the line into potentially actionable misrepresentations or when companies fail to adequately disclose potential limitations and risks of AI capabilities.

👉 In addition to AI cases, another possible securities class action trend to watch per Kevin LaCroix of the D&O Diary is cases against companies after they experience a data breach.

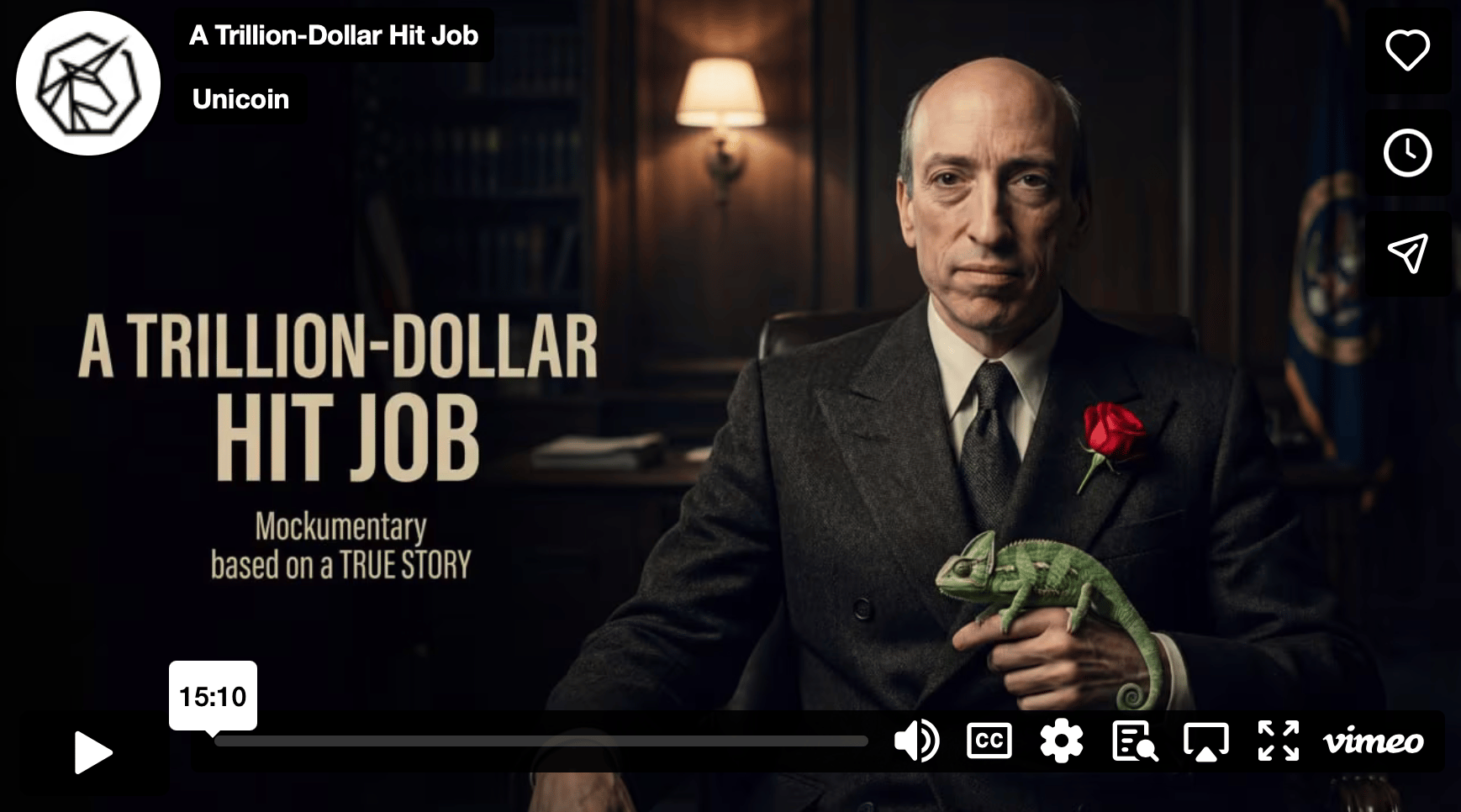

Video: “A Trillion-Dollar Hit Job”

Crypto company Unicoin has released this “mockumentary that offers a satirical yet searing look into the tenure of former SEC Chairman Gary Gensler and his crusade against the cryptocurrency industry.” Unicoin describes the mockumentary as “positing a dramatic retelling of the SEC’s lawfare against Unicoin, arguably the most compliant cryptocurrency company in the United States.”

SPONSORED BY

Securities Enforcement Forum New York 2026 is in one month!

This event is set for Thursday, February 5, 2026 at the historic JW Marriott Essex House. Join us in person or tune in virtually to hear from nearly 50 luminaries in the securities enforcement field—including numerous senior officials from the SEC and DOJ, in-house counsel from major corporations, and lawyers and consultants from the best firms and in the world.

👉 Please use the codes below to get a 25% early-bird discount (register here):

In-person attendance: UPDATE505NY

Virtual attendance: UPDATE505V