- Daily Update from Securities Docket

- Posts

- SEC Chairman Atkins: We Need to "Future-Proof" New Crypto Regulations

SEC Chairman Atkins: We Need to "Future-Proof" New Crypto Regulations

Plus DOJ official says 2025 was a "reset," white collar cases will now ramp up.

SPONSORED BY

Good morning! Here’s what’s up.

Clips ✂️

SEC Chair looks to ‘future-proof’ overhaul of crypto regulation

Paul Atkins, the chair of the US Securities and Exchange Commission, has embarked on a campaign to overhaul the agency’s crypto regulations.

And he doesn’t want a future administration to promptly undo his hard work.

“What is really important to me is that we future-proof what we’re doing,” Atkins said, “so that whatever happens down the road, we don’t have the pendulum swinging the other way, and then having a lot of our efforts washed away.”

He did not say what steps the agency would take in its attempt to lock in forthcoming changes.

Atkins was speaking at the Blockchain Association’s fourth annual policy summit in Washington, DC….

US Prosecutor in NY Says 2025 Was ‘Reset’ for White-Collar Crime

A high-ranking New York federal prosecutor signaled that white-collar enforcement would ramp up after a slower year but also said the Justice Department’s focus is shifting.

“If you have fewer people, you can bring fewer cases,” said Alixandra Smith, chief of the criminal division for the US Attorney’s Office for the Eastern District of New York, citing a hiring freeze and the government shutdown as factors that affected the office’s “output.”

“This year was a bit of a reset. We’ve now hired a bunch of new people. We’re getting in the door, and we continue to prioritize white-collar enforcement….

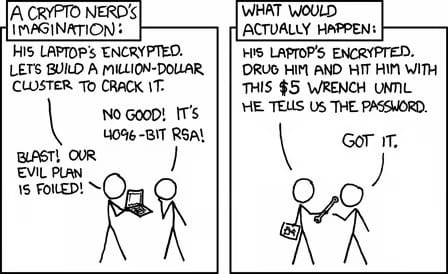

Crypto Traders Seek Out Extra Security as Kidnappings Rise

In response to this escalating threat, traders are hiring security firms to minimize their online footprints and remove any personal information that could pose a risk. They’re also taking real-life precautions. The term “wrench attack” comes from a webcomic whose punchline is that even the most sophisticated encryption is useless against a password-seeking attacker armed with a wrench.

The same people who were “all about buying Lambos, going to the moon, posting screenshots of their crypto wallets,” said Charles Finfrock, founder of private intelligence and security company Vigilance, are the ones now saying, “I probably made a mistake. I need to reduce my literal attack surface. Help me.”

Michael Saylor Urges Middle East to Become the ‘Switzerland of Bitcoin Banking’

Saylor claimed that the U.S. now leads the global regulatory shift toward bitcoin, pointing to what he described as near-unanimous support from government officials. “There is a profound consensus amongst everyone running the United States,” he said. “Donald J. Trump says he is intent on making America the bitcoin superpower, the crypto capital of the world, the leader in digital assets.”

He added that he had spoken personally with the Vice President, the Secretary of the Treasury, the head of the SEC, the Commerce Secretary, and other top officials, all of whom, Saylor claimed, view bitcoin as a strategic asset.

Saylor also said U.S. banks that once refused to touch bitcoin are now actively moving to support it.

“All of the large banks in the United States have gone from not banking bitcoin 12 months ago to, in the past six months, I have been approached by BNY, by Wells Fargo, by Bank of America, by Charles Schwab, by JPMorgan, by Citi,” he said. “They are all starting to issue credit against either Bitcoin or against Bitcoin derivatives like IBIT.”

👉 How is Michael Saylor not the “U.S. Secretary of Bitcoin” or something? The guy will not rest until everyone there are no more “no-coiners” on this planet.

SPONSORED BY

FTI Consulting expert Stephen Bucci, is quoted in Bloomberg Law discussing the slowdown in SEC earnings fraud and auditor liability cases and what it means for companies navigating today’s enforcement environment.

Read the full article for his insights on the evolving enforcement landscape: https://news.bloomberglaw.com/environment-and-energy/secs-earnings-fraud-auditor-liability-cases-plunge-under-trump