- Daily Update from Securities Docket

- Posts

- SEC Alleges $18 Million Offering Fraud Targeted at Retail Investors on Discord

SEC Alleges $18 Million Offering Fraud Targeted at Retail Investors on Discord

Plus a study linking binge-watching late-night TV shows with stock market declines.

SPONSORED BY

Good morning! Here’s what’s up.

Clips ✂️

SEC Charges Canadian Citizen With Fraud Schemes That Targeted Retail Investors on Discord

The Securities and Exchange Commission today charged Canadian citizen Nathan Gauvin and three entities he controls—Blackridge, LLC, Gray Digital Capital Management USA, LLC, and Gray Digital Technologies, LLC—with orchestrating two fraudulent securities offerings that raised more than $18 million from investors across the United States and abroad. Gauvin allegedly misappropriated approximately $6.3 million of investor funds and used fabricated credentials, false performance metrics, and fictitious account statements to lure investors into his schemes.

According to the SEC’s complaint, filed in the U.S. District Court for the Eastern District of New York, Gauvin gained a following on Discord by falsely presenting himself as a successful investment professional managing over a billion dollars in assets through Blackridge, which in reality was a mere shell entity. From September 2022 to November 2024, Gauvin and his entities allegedly raised approximately $18.1 million from investors through an unregistered offering of interests in the “Gray Fund,” a purported diversified investment fund advised by Gray Digital and Gauvin. The complaint alleges that Gauvin and Gray Digital falsely claimed that the Gray Fund generated double-digit monthly returns and held over $78 million in assets, when, in fact, the fund actually had a monthly compounded return of approximately 1.4% and its assets were far lower than claimed. The complaint further alleges that Gauvin misappropriated investor funds to finance a lavish lifestyle, including using hundreds of thousands of dollars for purchases of custom jewelry, luxury concierge services, real estate, and art.

👉 The SEC’s Complaint is here.

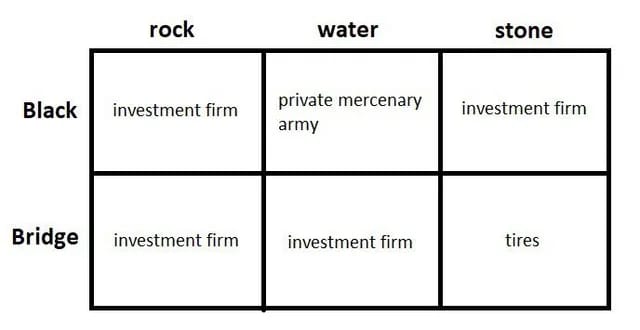

Blackridge? Is someone going to have to update this chart?

Franchise’s Brian Kahn Pleads Guilty to Defrauding Hedge Fund Investors

Brian Kahn, the former chief executive of Franchise Group Inc., pleaded guilty to defrauding hedge fund investors of about $300 million, a scandal that hastened the collapse of the retail company he built.

At a hearing Wednesday in federal court in Trenton, New Jersey, Kahn admitted he conspired to commit securities fraud at Prophecy Asset Management, which collapsed in 2020. Kahn’s crimes occurred as he secretly acted as Prophecy’s top trader while also building Franchise Group, or FRG, into a publicly traded company. He faces as many as five years in prison.

The Morning After: Late-night TV and the Stock Market

Binge-watching late-night TV shows has become far more common due to the popularity of streaming services such as Netflix and Amazon and their ‘dump release’ of new shows at midnight. We examine how the sleep loss associated with this phenomenon affects financial markets and find that market returns significantly decline on the day following the release of popular late-night shows. This effect is stronger in stocks with larger market-cap, and higher price. We show that sleepdeprived investors are less willing to make buying decisions since they require larger cognitive effort compared to selling decisions. Instead, they make more heuristicdriven sales, causing a decline in market returns. We also show that this proxy for sleep loss is superior to the one traditionally used in the literature, i.e., Daylight Savings Time change. Our findings are not driven by noise traders and are robust to a wide range of alternative explanations.

👉 Shout-out to the HKU Jockey Club Enterprise Sustainability Global Research Institute for making its first appearance in the Daily Update.

Artificial Intelligence Integration: Legal & Regulatory Essentials for Asset Managers

Fiduciary Duties

Asset managers generally have fiduciary duties to their clients, including the duty of care and the duty of loyalty. These duties require, among other things, appropriate diligence in selecting, engaging and overseeing AI service providers and disclosure to investors of risks and conflicts of interest associated with the use of AI. This oversight and disclosure must be analyzed in the context of the specific use case of AI. To fulfill their fiduciary duties to their clients and to avoid liability for failure to properly supervise their employees, asset managers should develop and adopt appropriate policies and procedures governing the use of AI.

One aspect of an asset manager’s fiduciary duties relates to proper allocation of expenses. In the context of a private fund manager, whether a particular AI expense is able to borne by a fund versus a manager is highly dependent on the fund governing documents and past practice…. […]

Data Storage and Information Governance

Asset managers should understand where and for how long an AI tool stores data, what types of data it retains (e.g., prompts, outputs, transcripts), the business purpose for the retention and whether its retention practices align with regulatory requirements and the asset manager’s information governance policies. It is important to assess whether the tool retains more or less data than necessary and whether there is potentially sensitive information stored in the AI tool itself, including material non-public information (“MNPI”).

University of Southern California Rolls Out Accelerated JD/MBA Program

The University of Southern California’s Gould School of Law and Marshall School of Business have partnered to roll out a fast-track J.D./MBA program.

USC Law is accepting applications for the fall semester for its dual degree program, touted as the “first and only program of its kind on the West Coast,” according to the school’s Monday announcement.