- Daily Update from Securities Docket

- Posts

- Court Sentences Do Kwon to 15 Years in Prison for "Fraud of Epic Generational Scale"

Court Sentences Do Kwon to 15 Years in Prison for "Fraud of Epic Generational Scale"

Plus SEC Commissioner Caroline Crenshaw is not leaving quietly.

SPONSORED BY

Good morning! Here’s what’s up.

Clips ✂️

Crypto Entrepreneur Do Kwon Gets 15-Year Prison Sentence

Disgraced crypto tycoon Do Kwon was sentenced to 15 years in prison on Thursday after pleading guilty to fraud in connection with the $40 billion crash of his TerraUSD and Luna coins in 2022.

Kwon, who had asked for a sentence of five years, pleaded guilty to two criminal counts in August, including one count of wire fraud and one on conspiracy to commit wire, securities and commodities fraud. In exchange for Kwon’s plea, federal prosecutors agreed to not seek a prison sentence of more than 12 years, and dropped seven other counts against him.

👉 Recap:

Kwon pleaded guilty in exchange for federal prosecutors’ agreement to not seek a prison sentence of more than 12 years.

Kwon asked the court to sentence him to 5 years.

Judge Paul A. Engelmayer of the SDNY then sentenced Kwon to 15(!) years in prison, finding that his crimes were “a fraud of epic generational scale” and that “in the history of federal prosecutions very few cases have caused more monetary harm than you did.”

Trend 4: Deterrence? What is That?

As the Commission dismisses investors, reduces transparency, and sends retail into the private markets wilderness, it cedes important tools: Its enforcement tools. We see this in multiple ways:

–The Commission has dismissed SEC enforcement actions left and right, undermining the credibility of our lawyers and the agency overall; –It has brought fewer enforcement actions;

–Civil penalties, when assessed, are purposefully lower;

–The purveyors of massive white-collar fraud are being pardoned or having their sentences commuted by the President, leading the Commission in many cases to drop its parallel litigations as an “exercise of its discretion”;

–Whistleblower awards have all but grounded to a halt;

–As I mentioned earlier, the Commission has given permission to issuers to enforce mandatory arbitration provisions against their shareholders, meaning (i) less private enforcement of the law, and (ii) confidentiality provisions that will keep corporate wrongdoing out of the public eye.

👉 Crenshaw threw a few more elbows in this speech on her way out the door of the SEC:

She analogized the current trend toward deregulation to the period prior to the stock market crash in 1929.

She said SEC staff numbers are down by between 15-20 percent and that she “cannot overemphasize how harmful the overnight loss of decades of institutional knowledge and securities expertise has been to our agency generally….”

She said that while the SEC now frequently says that it is a “new day,” anyone “aware of our place in the calendar knows that with each successive day the nights grow longer. I fear that the darkest depths of winter still lie ahead for America’s capital markets.”

Trump DOJ Defends Audit Board That Survived GOP Elimination Bid

The Trump administration continues to defend the US audit board in a constitutional court challenge despite efforts earlier this year by House Republicans to eliminate the regulator.

The Department of Justice filed a motion asking a federal judge to rule in favor of the government and the Public Company Accounting Oversight Board regarding a legal challenge testing the Enron-era audit regulator’s enforcement authority and funding. US attorneys intervened in the legal battle soon after the cases were first filed during the Biden administration to defend the Sarbanes-Oxley Act that created the audit board in 2002.

Key Takeaways

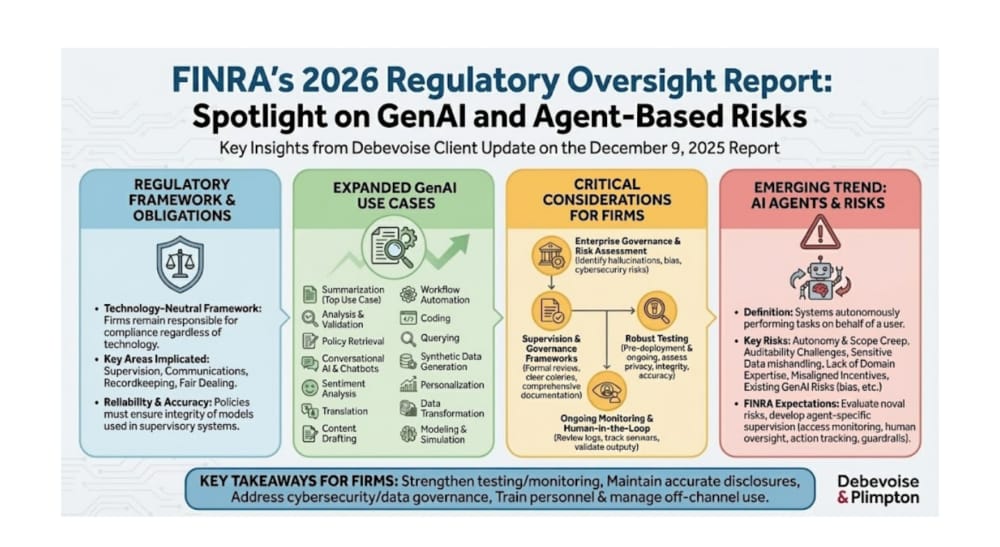

1. Given FINRA’s expansive guidance on GenAI and increasing scrutiny of agentic AI, firms may consider adopting the following GenAI governance and oversight measures: Strengthen Testing and Monitoring. Firms may want to revisit their GenAI testing and monitoring programs in response to FINRA’s expanded expectations. This process may include undertaking structured pre-deployment testing tailored to evaluate reliability, accuracy, and other performance characteristics, as well as establishing ongoing monitoring of prompts, outputs, and model behavior to confirm that GenAI tools continue to operate as intended.

2. Maintain Accurate and Balanced AI-Related Disclosures. As firms expand their use of GenAI and agentic AI, they may want to build additional processes to ensure that descriptions of these tools in customer communications and marketing materials remain accurate, comprehensive, and not overstated. As we have discussed here, the SEC and DOJ have brought AI washing charges against financial services firms for misstatements and omissions in connection with AI use, so building safeguards to test and ensure the accuracy of statements about AI’s capabilities and benefits can help reduce this enforcement risk….

👉 Article by Charu Chandrasekhar, Kristin Snyder, Jeff Robins, Avi Gesser, Matt Kelly and others at Debevoise.

SPONSORED BY

Securities Enforcement Forum New York 2026 is set for Thursday, February 5, 2026 at the historic JW Marriott Essex House! Join us in person or tune in virtually to hear from nearly 50 luminaries in the securities enforcement field—including numerous senior officials from the SEC and DOJ, in-house counsel from major corporations, and lawyers and consultants from the best firms and in the world.

👉 Please use the codes below to get a 25% early-bird discount (register here):

In-person attendance: UPDATE505NY

Virtual attendance: UPDATE505V